Itemized Deductions Form For 2024

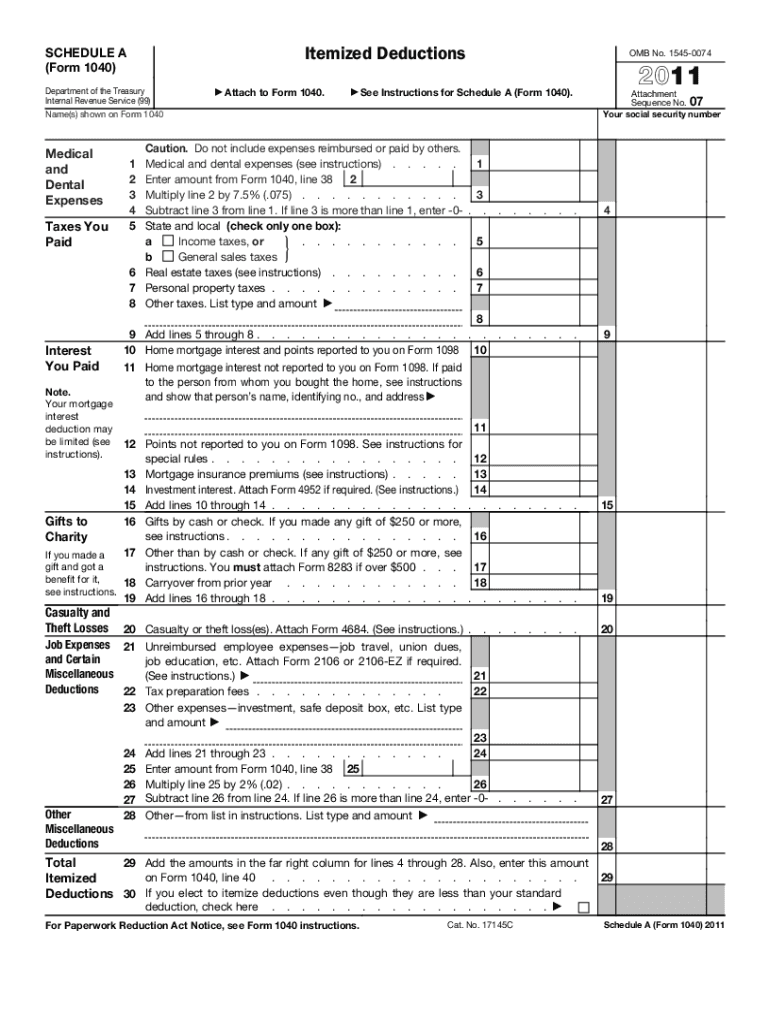

Itemized Deductions Form For 2024 – For roughly 1 in 10 taxpayers, itemizing deductions — rather than claiming the standard deduction — is the better game plan. Here’s why. . To claim your itemized deductions, fill out Schedule A of the Form 1040. Each line on the schedule describes a specific type of allowable expense that can be itemized. How to calculate itemized .

Itemized Deductions Form For 2024

Source : www.investopedia.comW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.comEmployee’s Withholding Certificate

Source : www.irs.govHere’s How to Fill Out the 2024 W 4 Form | Gusto

Source : gusto.com2024 Form W 4P

Source : www.irs.govPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govList of itemized deductions worksheet: Fill out & sign online | DocHub

Source : www.dochub.comW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.comIRS Form W 4P walkthrough (Withholding Certificate for Periodic

Source : www.youtube.comFree Tax Calculators & Money Saving Tools 2023 2024 | TurboTax

Source : turbotax.intuit.comItemized Deductions Form For 2024 All About Schedule A (Form 1040 or 1040 SR): Itemized Deductions: you’ll need to itemize your deductions using Form 1040 Schedule A. Your decision to itemize will depend on whether your itemized deductions are greater than your standard deduction. All of the . Writing off an expense may seem like an easy way to put money back in your pocket — but it is a little more complicated than that .

]]>:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)